ESS Tech (GWH)·Q4 2025 Earnings Summary

ESS Tech Strengthens Balance Sheet as Revenue Declines in Planned Pivot

January 29, 2026 · by Fintool AI Agent

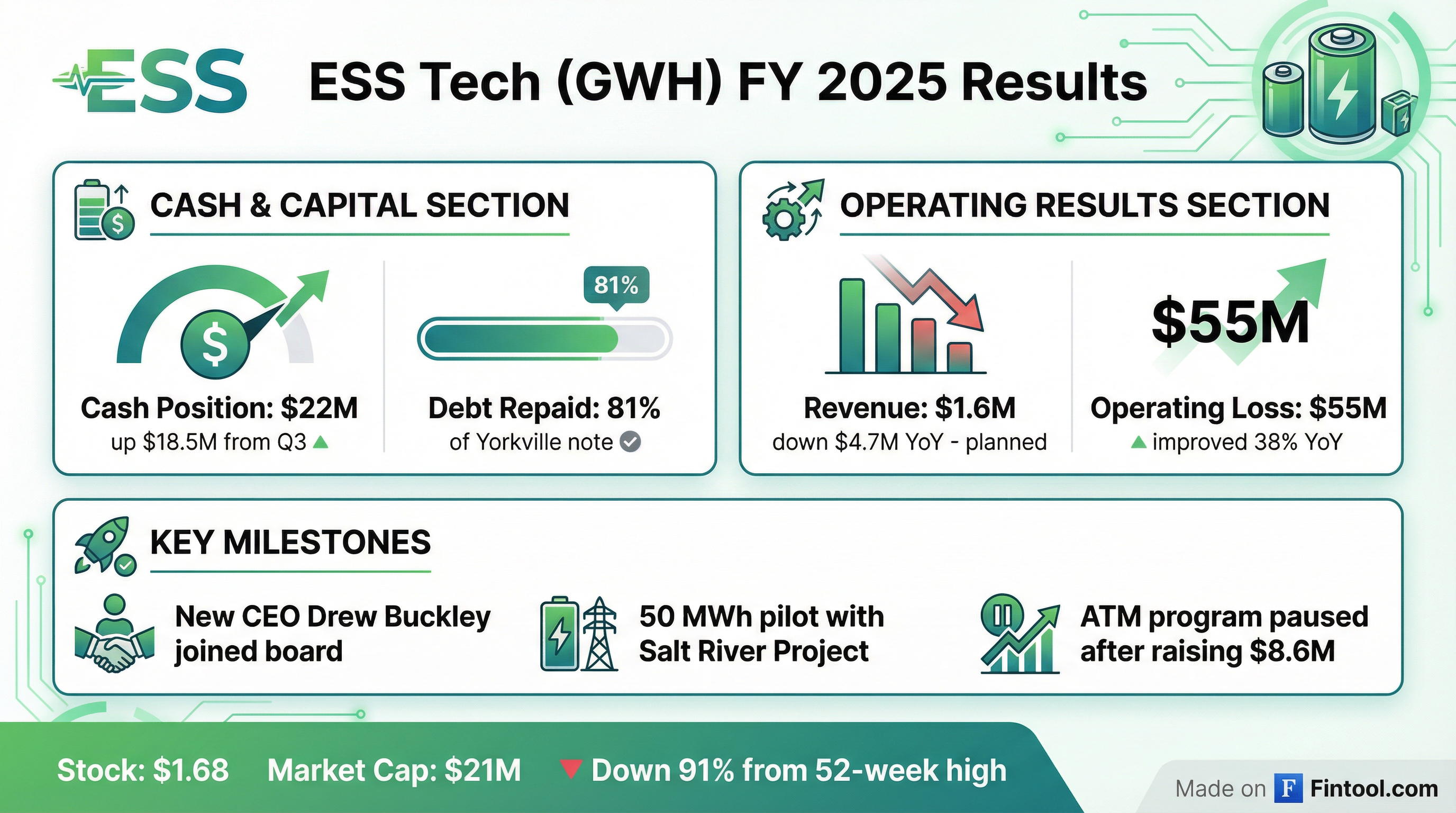

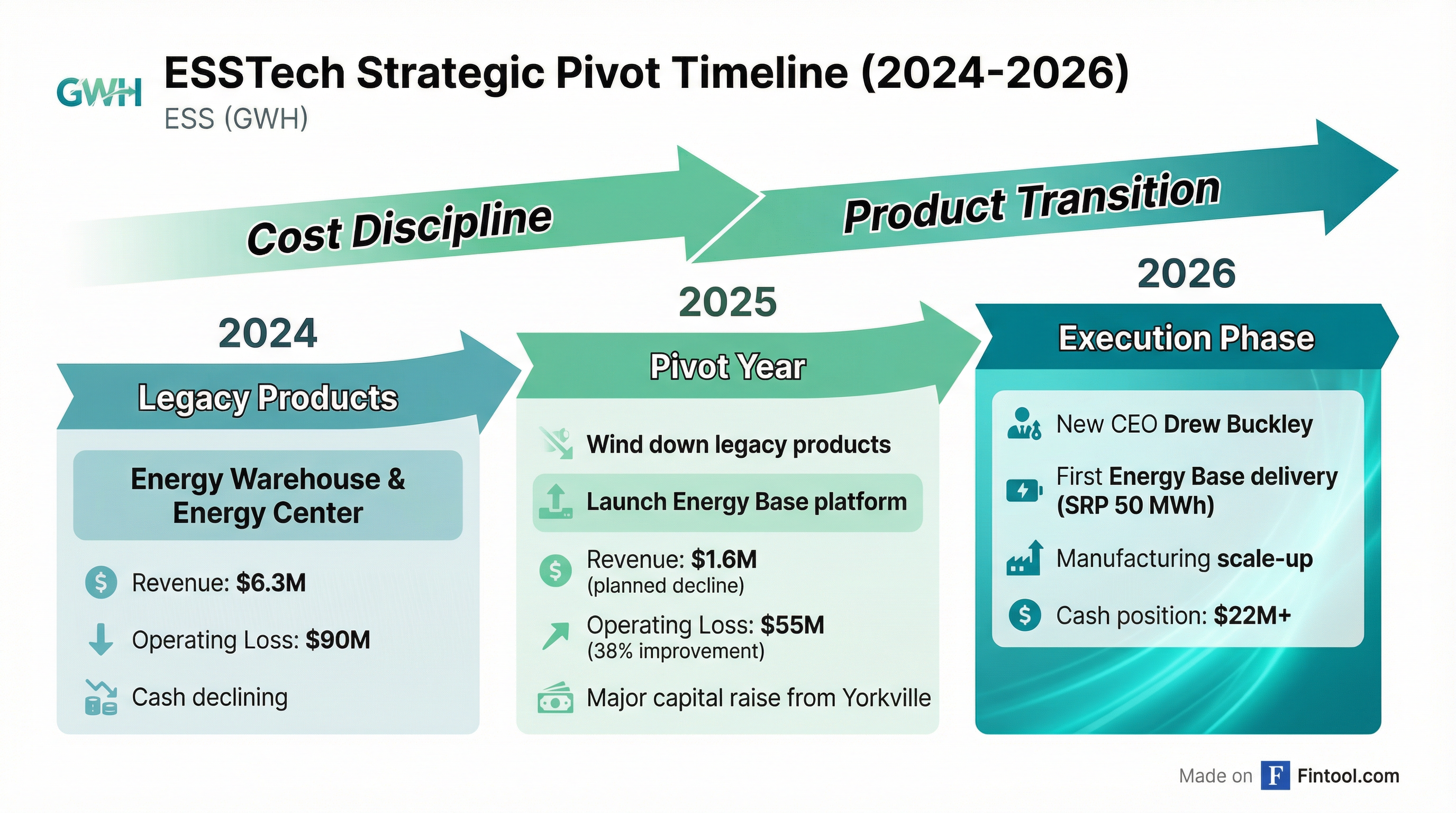

ESS Tech (NYSE: GWH) filed an 8-K on January 29, 2026 with preliminary unaudited financial results for fiscal year 2025, revealing significant progress on cost discipline and balance sheet strengthening even as revenue declined during the company's strategic pivot to the Energy Base platform.

The long-duration iron flow battery maker is executing a deliberate transition away from legacy Energy Warehouse and Energy Center products toward the new 10-hour Energy Base system, which represents 100% of the company's active pipeline.

What Are the FY 2025 Preliminary Results?

ESS Tech disclosed preliminary unaudited results for the full year 2025:

Key context: Revenue declined intentionally as the company wound down legacy product contracts to focus on the Energy Base platform. Management emphasized "ongoing cost discipline and a controlled approach to costs that allows the Company to efficiently execute its strategy."

What Happened to the Balance Sheet?

The most significant development was the dramatic improvement in liquidity:

Cash Position: Ended FY 2025 at ~$22.0 million, up $18.5 million from Q3 2025's $3.5 million.

Yorkville Debt: Repaid $24.4 million (81%) of the $30 million promissory note principal. Approximately $5.6 million remains outstanding. A second tranche of $10 million is available at the company's option until February 28, 2026.

ATM Program: Raised approximately $8.6 million in gross proceeds by issuing 3,799,160 shares through the at-the-market offering program launched November 13, 2025. The program has been paused.

This capital raise and debt repayment significantly de-risks the near-term execution timeline for the Energy Base platform.

How Did the Stock React?

ESS Tech shares closed at $1.68 on January 28, 2026 — down 0.6% in regular trading. The stock has been under sustained pressure:

The stock has declined sharply from its 2025 highs as the company executed its pivot away from revenue-generating legacy products. However, shares have recovered significantly from the 52-week low of $0.76, suggesting investors are giving credit for the balance sheet improvements and Energy Base progress.

What Changed from Last Quarter?

Comparing to Q3 2025 results:

The major shift is on the balance sheet, not the income statement. Cash surged from the Yorkville financing and ATM program proceeds, giving the company significantly more runway to execute the Energy Base strategy.

What Did Management Say About the Strategy?

From the Q3 2025 earnings call, then-Interim CEO Kelly Goodman outlined the strategic direction:

"Since launching the Energy Base earlier this year, 100% of our active opportunities are centered on this platform, with RFP activity and proposal volume continuing to increase. These engagements are larger in scale, longer in duration, and more strategically aligned with the needs of major utilities, data center developers, and industrial customers."

Key strategic elements:

- Energy Base: 10-hour duration iron flow battery platform, with 16-hour capability targeted by 2029

- Target customers: Utilities and IPPs, with bilateral conversations for data center opportunities

- First deployment: 50 MWh pilot with Salt River Project

- Go-forward projects: ~5 MW / 50 MWh scale with 100-200 MW follow-on potential

Who Is Running the Company?

A new leadership team took the reins effective January 1, 2026:

Drew Buckley was elected to the Board of Directors on January 23, 2026, bringing the Board from seven to eight members.

Chairman Harry Quarls noted: "Drew brings an incredible track record of success, with the experience and industry relationships necessary to lead ESS to its next stage, manufacturing and delivery of our first Energy Base projects, and broader commercialization expected to commence this year."

What Are the Key Risks?

Execution Risk: The company must successfully deliver its first Energy Base system to Salt River Project — there is no margin for error given the limited cash runway.

Dilution Risk: With a $21 million market cap and ongoing losses of ~$10-15 million per quarter, additional capital raises are likely. The ATM program is only "paused," not terminated.

Technology Risk: Iron flow batteries compete against increasingly cost-competitive lithium-ion systems. The value proposition requires long-duration (10+ hour) use cases where lithium economics break down.

Revenue Timing: No near-term revenue inflection is expected until Energy Base deliveries begin in late 2026 or 2027.

Historical Financial Performance

The operating loss improvement from ~$23M/quarter to ~$10M/quarter represents significant progress on cost discipline.

What's Next for ESS Tech?

Near-term catalysts:

- Investor Day planned for 2026 (date TBD)

- Energy Base manufacturing scale-up

- SRP 50 MWh pilot delivery (18-month timeline from Q3 2025 announcement)

Medium-term focus:

- Convert pipeline opportunities to contracted backlog

- Demonstrate field performance with SRP

- Expand to 100-200 MW follow-on projects

Financial outlook:

- Continued operating losses expected through 2026

- Additional capital needs likely as cash runway extends ~18-24 months at current burn

- Revenue inflection not expected until Energy Base deliveries commence